Five-Year Undergraduate Enrollment Trends

Five-Year Undergraduate Enrollment Trends

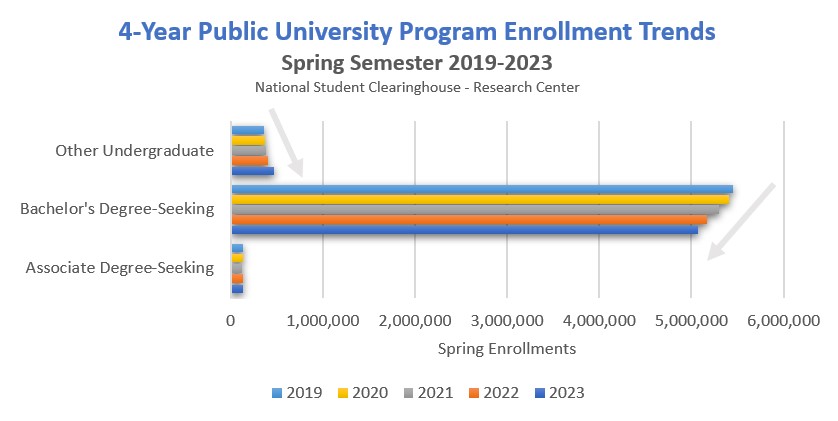

Spring Enrollments: 5 Year Trends at Public 4 Year Universities

Enrollment data compiled by the National Student Clearinghouse – Research Center has nuanced trends at the program level at Public-4 Year Universities. It shows that undergraduate enrollment is increasing in shorter programs, while declining in 4-year bachelor’s degrees. This is aligned with public sentiment of increasing skepticism of the benefits of a 4-year undergraduate degree due to escalating costs.

I focused on Public-4 Year Universities because among other sectors, it is the largest. Forty percent of all 2023 undergraduate spring enrollees attended a public 4-year university.

Total Undergraduate Enrollment is Down

At the top level, from spring 2019 to spring 2023, total undergraduate enrollment declined almost 5% to 5.6 M. That is a decline of nearly 274 K enrollments over 5 years. This matches long-term demographic trends that show declines through 2026 due to falling levels of high school graduates.

Growth Programs within Undergraduate

Next, I looked for undergraduate programs that are growing. The chart here shows declining 4-year bachelor’s degrees while shorter Other Undergraduate has a 5-year growth trend. Similarly, spring enrollment in associate degrees, typically a 2-year program, had growth over the last 3 years.

Other Undergraduate include undergraduate certificates/diploma, teacher preparation, special non-credential programs that have been classified by the institution as undergraduate. This program category is more than 8% (474.8 K out of 5.6 M) of all undergraduate 2023 spring enrollments at Public-4 Year Universities, which makes it small but not insignificant.

The historical 5-year growth trend of shorter undergraduate programs did precede the pandemic. Meanwhile the Wall Street journal continues to report that the 4-year undergraduate degree job requirement is being eliminated at both private and public employers. Employers care about specific skills, which ties into shorter skills-based certificate programs. These factors support future growth in shorter undergraduate programs.

Loan Program Approach

Due to smaller costs of education in shorter undergraduate programs, a private student loan should be structured with a shorter term. Underwriting should consider the shorter term and the relative small loan size. Marketing needs to focus this short term loan product to enrollees of these shorter undergraduate programs. It reminds me of the buy-now-pay later installment loan product, a whole new loan product to meet the needs of these lower educational costs that is occuring on-line in a faster customer decisioning process.

Consulting by Einstein Higher Edu Solutions

Einstein Higher Edu Services provides deep domain expertise and advanced data analytic capabilities to optimize the management of risks to your traditional and new private student loan products. Risk expertise, machine learning, and loan program development are some areas where Einstein can provide lift to your organization. I look forward to having high-level decisions with private student loan lenders that are interested in this area or other areas.

Lenders need to tailor a loan program that is short-term, develop new marketing strategies and provide the application experience that should be different than that of traditional student loans.

Aaron Pisacane

Founder, Einstein Higher Edu Solutions

Affiliate sponsor of the Education Finance Council.

(917) 968-6483